Cryptocurrency Market Risks: Understanding and Mitigating the Challenges

summary:

Cryptocurrency Market Risks: Understanding the risks involved in the cryptocurrency market...

summary:

Cryptocurrency Market Risks: Understanding the risks involved in the cryptocurrency market... Cryptocurrency Market Risks: Understanding the risks involved in the cryptocurrency market and strategies to mitigate those challenges. Investors should be aware of the volatile market conditions and take necessary steps to reduce potential losses.

In the fast-paced world of digital finance, cryptocurrencies have emerged as a revolutionary form of asset class, promising unprecedented levels of security, transparency, and accessibility. However, this new and volatile market is not without risks. Cryptocurrency investors face a range of challenges that can impact their investments, from market volatility to regulatory uncertainties and security threats. It is crucial to understand these risks and develop strategies to mitigate them.

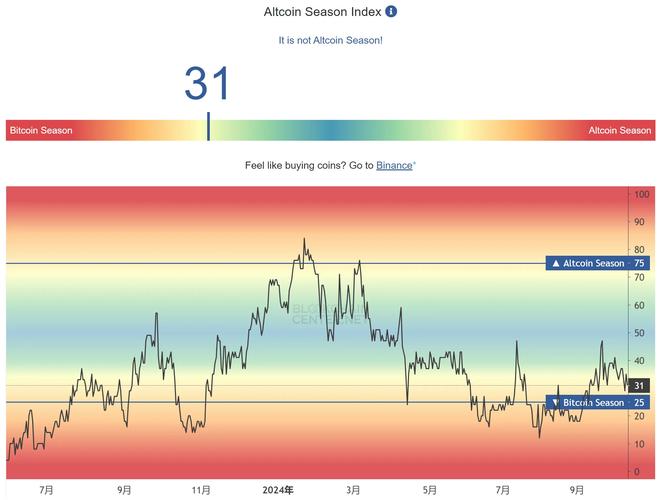

Market Volatility

Cryptocurrencies are known for their high levels of volatility, which can result in significant price fluctuations over short periods. This volatility is driven by several factors, including investor sentiment, regulatory news, and technological advancements. Market volatility can create significant risks for investors, as the value of their holdings can rise or fall sharply without warning. To mitigate this risk, investors should diversify their portfolios by investing in multiple cryptocurrencies and allocate funds based on their risk tolerance. Additionally, they should closely monitor market developments and stay informed about the latest news and trends that could impact prices.

Regulatory Uncertainty

Another major risk facing cryptocurrency investors is regulatory uncertainty. As cryptocurrencies are a new and emerging asset class, the regulatory framework surrounding them is still developing. Different countries have different approaches to regulating cryptocurrencies, which creates a complex and uncertain environment for investors. Regulatory uncertainties can impact the price and liquidity of cryptocurrencies, as well as the ability of investors to trade them freely. To mitigate this risk, investors should stay informed about regulatory developments in their jurisdiction and consider investing in cryptocurrencies that are less sensitive to regulatory changes. Additionally, they should support industry efforts to establish clear and consistent regulatory frameworks that promote fair competition and protect investors.

Security Risks

Security risks are a major concern for cryptocurrency investors. As cryptocurrencies are digital assets, they are vulnerable to hacking attacks, which can result in the loss of funds or sensitive information. To mitigate this risk, investors should ensure that they use strong passwords and enable two-factor authentication on their cryptocurrency exchanges and wallets. Additionally, they should only use trusted and verified platforms for trading and store their funds in secure wallets with robust security measures. Moreover, it is important to stay vigilant against phishing attacks and other forms of fraud that could compromise personal information and access to funds.

Market Manipulation and Lack of Transparency

Another risk facing cryptocurrency investors is market manipulation and lack of transparency. As cryptocurrencies are decentralized and lack the oversight of traditional financial markets, they are vulnerable to manipulation by large investors or groups. Additionally, some cryptocurrency exchanges may not provide accurate or timely information about their order books or trading activity, which can make it difficult for investors to make informed decisions. To mitigate these risks, investors should conduct thorough research on the exchanges they use and ensure that they are regulated and have robust anti-manipulation measures in place. Additionally, they should stay informed about market developments and avoid making investment decisions based on unverified information or rumors.

Market Risks Specific to Individual Cryptocurrencies

While the above risks are common across the cryptocurrency market, individual cryptocurrencies also have their own unique risks. These risks are related to the specific technology, team, and use case of each cryptocurrency. For example, some cryptocurrencies may be more vulnerable to hacking attacks due to technical vulnerabilities in their code or poor security practices by their development team. Others may be affected by competition from other cryptocurrencies with similar features or better technology. To mitigate these risks, investors should conduct thorough research on individual cryptocurrencies before investing and stay informed about their latest developments and security updates.

Conclusion

Cryptocurrency investing offers significant opportunities for those willing to take risks and conduct thorough research. However, it is crucial to understand the challenges and risks involved in this market before making any investment decisions. Market volatility, regulatory uncertainty, security risks, market manipulation, and risks specific to individual cryptocurrencies are all factors that could impact an investor's portfolio. By staying informed, diversifying their portfolios, and mitigating these risks through careful research and strategic planning, investors can navigate the cryptocurrency market more effectively and reduce their exposure to potential losses.