BTC/USD: The Rise and Evolution of Bitcoin in the Global Economy

summary:

BTC/USD: The rise and evolution of Bitcoin in the global economy. This overview will explo...

summary:

BTC/USD: The rise and evolution of Bitcoin in the global economy. This overview will explo... BTC/USD: The rise and evolution of Bitcoin in the global economy. This overview will explore how Bitcoin has gradually become a global phenomenon, how its value and influence have grown over time, and how its place in the financial system has gradually become more secure.

In the realm of digital currencies, Bitcoin stands supreme as the pioneer and most valuable cryptocurrency in the world. Its price against the US Dollar (BTC/USD) has experienced remarkable fluctuations since its inception, attracting investors, enthusiasts, and even critics. In this article, we will explore the rise of Bitcoin in the global economy and its impact on the BTC/USD exchange rate.

Introduction

Bitcoin, introduced in 2009, was the first-ever cryptocurrency, designed to facilitate peer-to-peer transactions without the need for intermediaries like banks or payment gateways. Initially, the value of Bitcoin was negligible, but over time, its popularity grew, leading to a surge in its price against the US Dollar.

Understanding BTC/USD

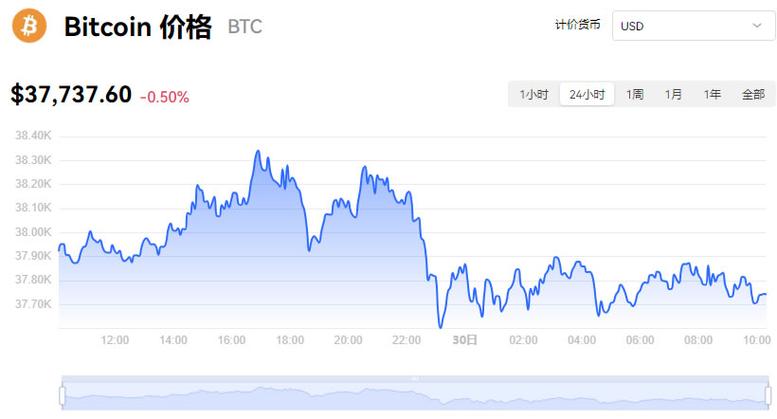

The BTC/USD exchange rate represents the value of Bitcoin in terms of the US Dollar. As a global currency pair, it is one of the most actively traded pairs in the cryptocurrency market. The price of Bitcoin is highly volatile, experiencing significant fluctuations due to various factors such as market sentiment, technological developments, regulatory policies, and global economic conditions.

History of Bitcoin's Price Evolution

Since its inception, the price of Bitcoin has experienced remarkable growth. In its early days, the value of Bitcoin was almost negligible. However, as more people became aware of its potential and started investing in it, its price began to rise. The first major surge in Bitcoin's price occurred in 2013, when it reached a high of $1,200 from less than $100 just a year prior.

The next major milestone was reached in 2017, when Bitcoin's price surged to nearly $20,000, sparking widespread interest and attracting investors from all over the world. However, the price experienced a sharp correction in 2018, dropping significantly. Since then, Bitcoin has experienced several ups and downs but has continued to maintain its position as the leading cryptocurrency in the market.

Factors Influencing BTC/USD

1、Market Sentiment: The sentiment of market participants plays a crucial role in determining the price of Bitcoin. Positive sentiment, such as increased adoption and institutional investment, can drive the price up, while negative sentiment, such as regulatory crackdowns or market corrections, can lead to price declines.

2、Technological Developments: The underlying technology of Bitcoin, blockchain, is constantly evolving. New developments such as lightning network, smart contracts, and decentralized finance (DeFi) are expected to drive the demand for Bitcoin and positively impact its price.

3、Regulatory Policies: Regulatory policies regarding cryptocurrencies can have a significant impact on the price of Bitcoin. Supportive regulations can drive adoption and increase investor confidence, leading to higher prices. Conversely, restrictive regulations can cause uncertainty and lead to price declines.

4、Global Economic Conditions: The global economy plays a significant role in determining the price of Bitcoin. Factors such as interest rates, inflation, and geopolitical events can influence investor sentiment and drive demand for Bitcoin as a store of value or alternative investment asset.

Impact of BTC/USD on Global Economy

The rise of Bitcoin and its increasing popularity have had significant impacts on the global economy. Firstly, it has transformed the financial industry by enabling cross-border payments and reducing the reliance on traditional financial institutions. Secondly, Bitcoin has sparked the development of a whole new industry ecosystem, including mining, exchanges, wallets, and other related services. Thirdly, Bitcoin has become a store of value and a hedge against inflation in many countries, attracting investors from all over the world.

Conclusion

The BTC/USD exchange rate represents the evolving journey of Bitcoin in the global economy. Its price fluctuations reflect the interplay of various factors such as market sentiment, technological developments, regulatory policies, and global economic conditions. As Bitcoin continues to mature and gain wider adoption, its impact on the global economy is expected to grow further.

In this article, we have explored the rise of Bitcoin in the global economy and its impact on the BTC/USD exchange rate. As we move forward, we will continue to witness the evolution of Bitcoin and its role in shaping the future of finance and global economy.