Bitcoin Micro Payments: The New Era of Digital Payment Revolution

summary:

Bitcoin Micro Payments herald the new era of digital payment revolution. With its ability...

summary:

Bitcoin Micro Payments herald the new era of digital payment revolution. With its ability... Bitcoin Micro Payments herald the new era of digital payment revolution. With its ability to process payments in fractions of a cent, Bitcoin offers a highly efficient and convenient solution for digital transactions, revolutionizing the way we pay for online services and products.

Title: Bitcoin Micro Payments - Embracing the Digital Payment Revolution

In the realm of digital finance, Bitcoin has emerged as a revolutionary concept that has revolutionized the way we think about money and payments. As the world moves towards a cashless society, Bitcoin and its underlying blockchain technology have opened up new avenues for secure and efficient transactions. Among the many use cases of Bitcoin, micro payments stand out as a promising application that has the potential to transform the way we make small payments in our daily lives.

What are Micro Payments?

Micro payments are small value transactions that are processed quickly and efficiently without the need for traditional banking infrastructure. These payments are typically made for digital goods and services such as online content, software updates, in-app purchases, and more. With the advent of Bitcoin, micro payments have become faster, cheaper, and more convenient than ever before.

How do Bitcoin Micro Payments Work?

Bitcoin micro payments leverage the blockchain technology that powers Bitcoin to facilitate secure and transparent transactions. The blockchain is a decentralized database that records transactions in blocks and chains them together, ensuring immutability and accountability. With Bitcoin, micro payments can be processed directly between two parties without the need for intermediaries such as banks or payment gateways.

One of the key advantages of Bitcoin micro payments is the near-zero transaction fees. Traditional payment methods often charge high fees for small transactions, which can be a significant burden for businesses and individuals. By contrast, Bitcoin micro payments allow for almost free transfers, making them ideal for digital content delivery, in-app purchases, and other small value transactions.

Moreover, Bitcoin micro payments are highly scalable. The blockchain can handle a vast number of transactions simultaneously, ensuring that even with a high volume of micro payments, the system remains efficient and responsive. This scalability is particularly beneficial for businesses that rely on frequent small transactions to generate revenue.

Use Cases for Bitcoin Micro Payments

1、Digital Content Delivery: Bitcoin micro payments are ideal for digital content such as online articles, videos, and music. Publishers and content creators can set micro-pricing for their content and receive payments instantly without waiting for traditional payment gateways or intermediaries.

2、In-App Purchases: Mobile applications can leverage Bitcoin micro payments to offer in-app purchases without relying on third-party payment gateways. This not only reduces transaction fees but also speeds up the payment process, enhancing user experience.

3、Software Updates and Subscriptions: Software developers can use Bitcoin micro payments to charge for software updates or subscription services. Users can pay with Bitcoin seamlessly, without having to create an account or provide sensitive financial information.

4、IoT (Internet of Things): The Internet of Things is another promising use case for Bitcoin micro payments. Smart devices such as thermostats, smartwatches, and home appliances can be connected to the blockchain to facilitate secure and efficient micro payments for services like energy usage or subscription services.

Challenges Facing Bitcoin Micro Payments

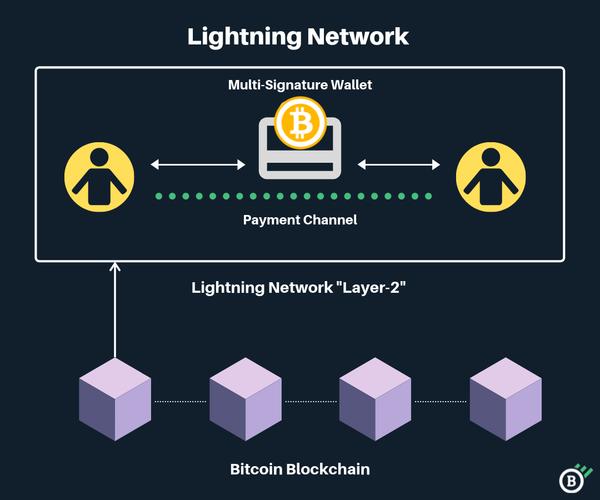

Despite the numerous advantages of Bitcoin micro payments, there are some challenges that need to be addressed for widespread adoption. One of the main challenges is scalability. As the number of transactions increases on the blockchain, it can lead to congestion and slow transaction speeds. Although there are solutions such as Lightning Network that aim to address scalability issues, they still need to be widely adopted and tested.

Another challenge is the lack of user-friendly interfaces for Bitcoin micro payments. While the underlying technology is robust, making it easy for users to send and receive micro payments remains a challenge. There is a need for user-friendly interfaces and wallets that simplify the process of making small payments with Bitcoin.

Lastly, regulation is a key challenge facing Bitcoin micro payments. As Bitcoin and blockchain technology evolve, regulatory frameworks need to be updated to accommodate these new technologies. Clarity on regulatory guidelines will help foster trust among users and businesses, leading to broader adoption of Bitcoin micro payments.

Outlook for Bitcoin Micro Payments

Despite the challenges, the outlook for Bitcoin micro payments is promising. With the continued evolution of blockchain technology and the adoption of solutions such as Lightning Network, we can expect faster and more efficient micro payments in the future. As more businesses embrace digital payment methods, Bitcoin micro payments are poised to become a viable option for small value transactions.

Moreover, with the rise of digital content and services, there is a growing demand for secure and convenient payment methods. Bitcoin micro payments offer a seamless payment experience without the need for intermediaries or high transaction fees. This could lead to broader adoption of digital content and services, driving the growth of the digital economy.

In conclusion, Bitcoin micro payments represent the new era of digital payment revolution. With their efficiency, scalability, and low transaction fees, they have the potential to transform the way we make small payments in our daily lives. As we move towards a cashless society, Bitcoin micro payments could become a ubiquitous part of our financial lives, facilitating secure and efficient